Download the Financial Aid Checklist and make sure you are prepared.

Most colleges in the country increase their tuition and fees every year, but AAC is the first and only private art school in the country to implement a Four-Year Tuition Promise! The Financial Aid Office is dedicated to help you not only through the Free Application for Federal Student Aid (FAFSA) process, but to also provide you with additional avenues to help pay for your college education when needed. Most of our students receive some form of financial aid, ranging from competitive scholarships to need-based grants and loans.

You can rest assured that the AAC Financial Aid Office will provide you with the information you need to make a sound financial decision. This information will be provided through the students’ Campus Café portal, as well as a one-on-one conversation between the student/family and the Financial Aid Department.

The financial aid process can be challenging, and sometimes additional documents are required to process your financial aid. Both the student, as well as their parent(s) (if dependent), can help this process by checking the email listed on your admission application and FAFSA frequently. The AAC Financial Aid Office will do everything in its power to get your financial aid package processed as soon as possible, though we will need your participation during the process.

If you have any questions, please do not hesitate to contact our office. We are here to help!

Three big changes tot he new FAFSA:

Additional Updates on the 2024-25 aid process will be noted here.

Student status for purposes of financial aid is defined by federal regulations and is determined through a series of questions when completing the Free Application for Federal Student Aid (FAFSA). The Art Academy of Cincinnati and the State of Ohio follow these same regulations when determining aid eligibility.

NOTE: When completing the FAFSA, you are likely not to be asked all of these questions. If your answers to simplified versions of these questions provide enough information, the system will avoid taking the student through a long series of somewhat complicated scenarios as described in full below.

Dependent students are required, when completing the FAFSA, to include parental information. Independent students do not have to use parental financial and household information when filing their FAFSA.

You are considered a dependent student for aid purposes unless one or more of the following very specific conditions is met:

Some students find themselves in more extreme situations that prevent a student from being able to have parents complete the FAFSA. If you don’t know where your parents are or you’ve left home due to an abusive situation, contact the AAC Office of Financial Aid. We can assist you with the proper course of action.

Parent refusal or desire not to complete the FAFSA is not the same as an inability for parents to complete the FAFSA.

There are many sensitive family issues, and staff will work with you within federal regulation limitations to get you the proper aid.

For the Dependency Override Form – please email us at financialaid@artacademy.edu

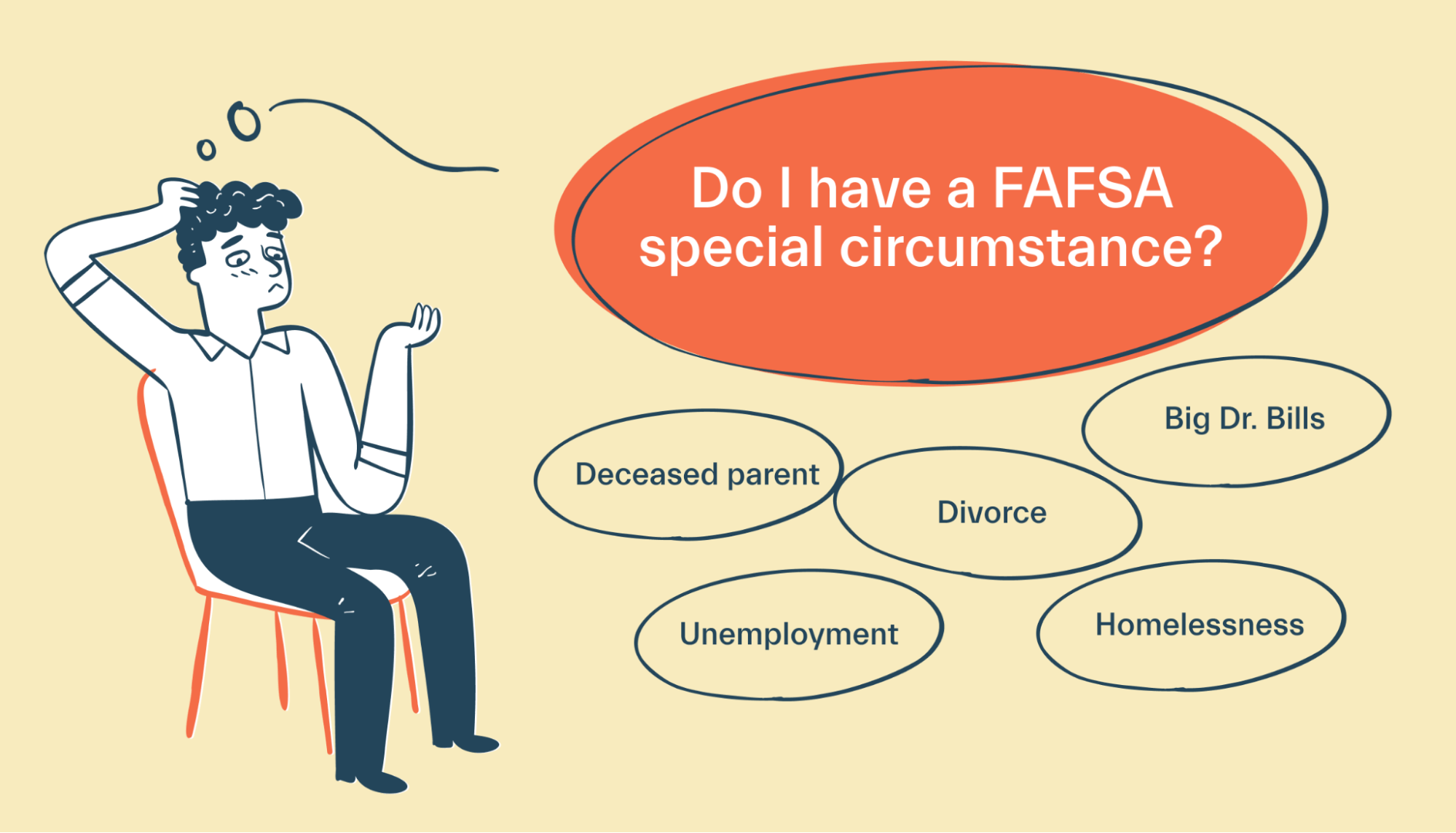

Your FAFSA is completed using financial data from two years ago. While most families experience consistent income from year to year, other situations like job loss, retirement, death, or divorce can change income matters significantly. We will review such a situation with an eye on how it may affect your aid eligibility. Ultimately, staff can help to determine if your situation is worth your extra effort to collect additional documentation.

Students who have specific expenses related to their cost of education (i.e., child care for preschool-aged children, instrument purchases for performance majors) can request an appeal via the AAC Office of Financial. However, recognize that such increases usually only impact some graduate and parent plus loan borrowing.

For the Special Circumstances Form – please email us at financialaid@artacademy.edu

Download the Financial Aid Checklist and make sure you are prepared.

Financial Aid documents are due within three weeks of being requested, and no later than April 1 for current students and July 15 for incoming students. It is strongly encouraged that students (incoming & returning) meet with the Financial Aid Office for a Financial Aid Package Review before they can register for classes.

Please click on the link below to complete the 2024-2025 Verification Worksheet:

* Please check your email listed on the FAFSA regularly.

**Documents can be submitted to the Financial Aid Office via email, fax, or mail.

AAC scholarships will be disbursed from the Financial Aid Office to the Business Office shortly before the start of each semester.

Outside scholarships will be disbursed once AAC has received the check from the outside (non AAC) foundation. Outside scholarships will be split into two disbursements (Fall & Spring) unless noted otherwise.

Federal Financial Aid will be disbursed from the Department of Education to the eligible student’s tuition accounts on or around the second week of each semester, provided that the student and/or parent have submitted all the required documents on time. Once the federal aid has been disbursed to the tuition account a Title IV refund will be processed within 14 days to those that have a credit balance on their tuition account.

Aid from the State of Ohio (OCOG) will be disbursed closer to the middle of the semester once AAC has received the funds from the state.

Though Financial Aid is disbursed at the beginning of the semester it is earned throughout the semester. If you withdraw from classes after the first day of the semester your aid is subject to change, per Department of Education regulations. This adjustment may result in a balance owed to the school, as the school is required to return any unearned funds to the Department of Education on the student’s behalf.

If you have any questions or concerns, please feel free to contact the AAC Financial Aid Office, as we are always here to help!!

Hours: Monday – Friday, 9 a.m. to 4 p.m.

Email: financialaid@artacademy.edu

Phone: 513-562-8751

Fax: 513-562-8778

Mail:

Art Academy of Cincinnati

Attention: Financial Aid

1212 Jackson Street

Cincinnati 45202

The 2024-25 FAFSA is currently available at http://studentaid.gov

If you have any questions, please do not hesitate to contact our office. We are here to help.

There will be three more obvious changes that all families will experience when completing the new FAFSA.

EFC becoming SAI is more than a name update. The calculation of the SAI differs from the EFC calculation of the past and makes the following changes that may change your aid eligibility:

Additional Updates on the 2024-25 aid process will be noted here.

Watch the 2024-25 FAFSA FAQs playlist to better understand what’s changed on the new 2024-25 FAFSA form.

Student status for purposes of financial aid is defined by federal regulations and is determined through a series of questions when completing the Free Application for Federal Student Aid (FAFSA). The Art Academy of Cincinnati and the State of Ohio follow these same regulations when determining aid eligibility.

NOTE: When completing the FAFSA, you are likely not to be asked all of these questions. If your answers to simplified versions of these questions provide enough information, the system will avoid taking the student through a long series of somewhat complicated scenarios as described in full below.

Dependent students are required, when completing the FAFSA, to include parental information. Independent students do not have to use parental financial and household information when filing their FAFSA.

You are considered a dependent student for aid purposes unless one or more of the following very specific conditions is met:

Some students find themselves in more extreme situations that prevent a student from being able to have parents complete the FAFSA. If you don’t know where your parents are or you’ve left home due to an abusive situation, contact the AAC Office of Financial Aid. We can assist you with the proper course of action.

Parent refusal or desire not to complete the FAFSA is not the same as an inability for parents to complete the FAFSA.

There are many sensitive family issues, and staff will work with you within federal regulation limitations to get you the proper aid

For the Dependency Override Form – please email us at financialaid@artacademy.edu

Your FAFSA is completed using financial data from two years ago. While most families experience consistent income from year to year, other situations like job loss, retirement, death, or divorce can change income matters significantly. We will review such a situation with an eye on how it may affect your aid eligibility. Ultimately, staff can help to determine if your situation is worth your extra effort to collect additional documentation.

Students who have specific expenses related to their cost of education (i.e., child care for preschool-aged children, instrument purchases for performance majors) can request an appeal via the AAC Office of Financial. However, recognize that such increases usually only impact some graduate and parent plus loan borrowing.

For the Special Circumstances Form – please email us at financialaid@artacademy.edu

Additional generous support from: John J. & Mary R. Schiff Foundation, P&G Fund of The Greater Cincinnati Foundation, Thomas R. Schiff Foundation, Hamilton County.